Modeling a Leveraged Buyout (or LBO) in Excel is a process with several steps. The first step is to create transaction assumptions. Transaction assumptions help determine the actual funds required to complete the transaction. This can be quite different to the purchase price when fees and equity rollovers are accounted for. The transaction assumptions also include the debt terms of the model.

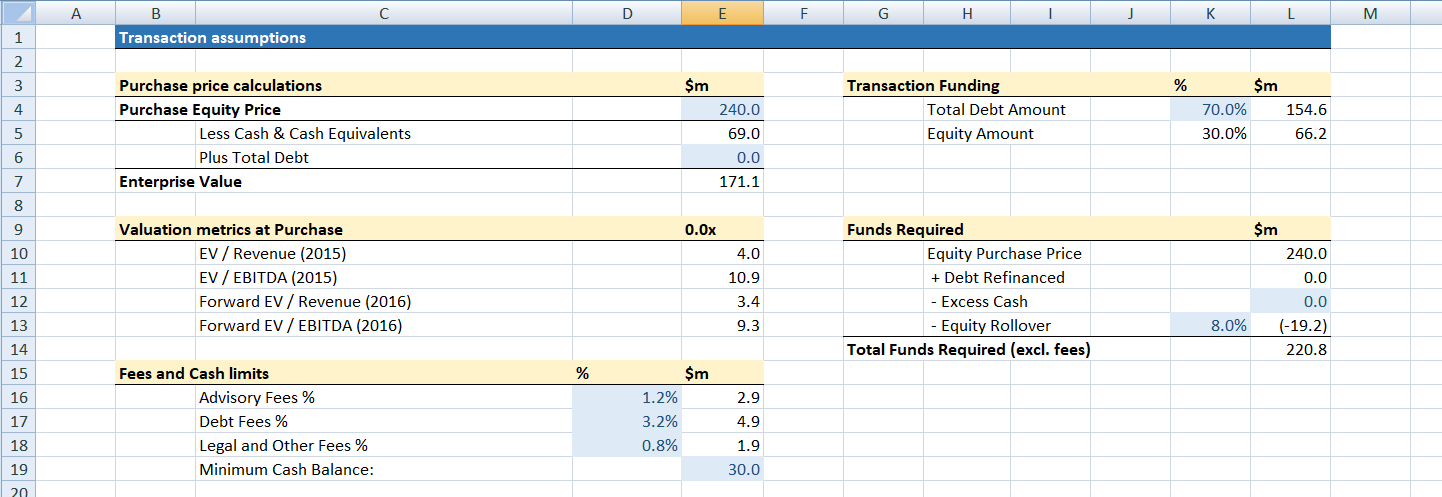

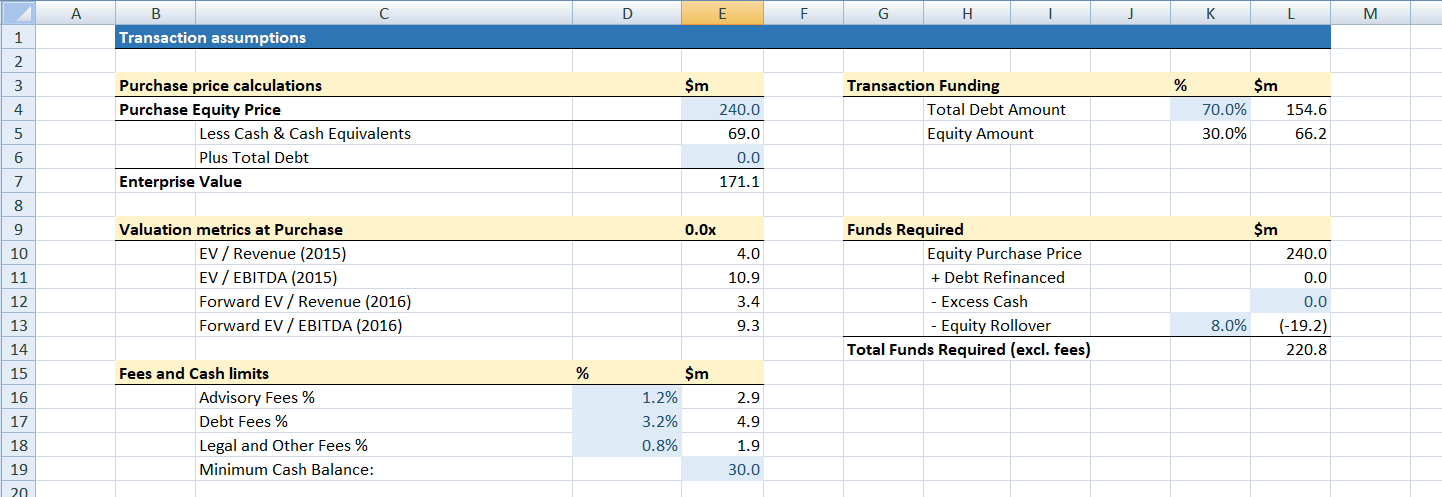

Below, we can see a set of transaction assumptions for an LBO Model in Excel. This models the buyout of a company called MarkerCo by a private equity form, PrivEq. It’s worth noting that this model refers to the company that is being bought as part of the LBO, in this case MarkerCo. In this post, we’ll explain each of these sections in turn.

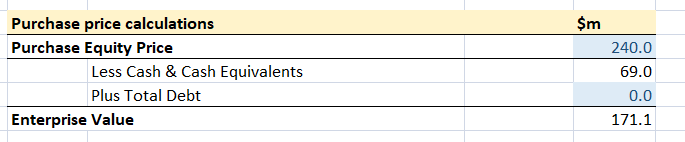

Purchase Price Calculations

This section calculates the enterprise value of the company being acquired. We start with the purchase equity price, which is the price demanded by the board of MarkerCo. We then subtract cash and cash equivalents and add net debt. Both of these figures can be found on MarkerCo’s balance sheet. In this case, MarkerCo has a reasonable cash pile and no debt, which reduces the enterprise value of the transaction.

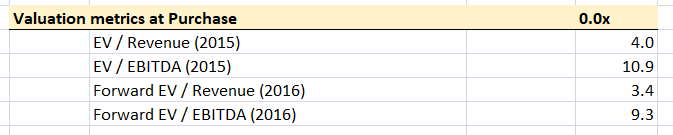

Valuation Metrics at Purchase

Once we have calculated the Enterprise Value, we can calculate various valuation metrics by dividing EV by Revenue or EBITDA. Revenue and EBITDA can be found in the Income Statement. In this case, the LBO is taking place in 2016, so we calculate metrics for 2015, which is the last year before the LBO. We then calculate forward projections of these multiples for 2016, the first year after the LBO. These metrics are not needed at this stage of the LBO process, but can be used later on when making assumptions for the Exit multiple.

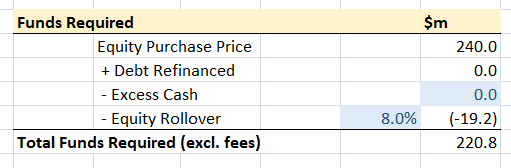

Funds Required

The funds required to complete an LBO are not necessarily the same as the equity purchase price. PrivEq may also need to refinance MarkerCo’s existing debt, which would require additional funding. However in our example, MarkerCo has no debt, so this figure is zero. If MarkerCo has excess cash, this can be used to partially finance the deal, reducing the funds required. Although MarkerCo has cash on their balance sheet, this item is zero, because we often can’t be sure at the assumptions stage of the model if excess cash will be available. We could change this figure.

The final figure here is equity rollover. If existing management in MarkerCo hold shares in the company, and wish to rollover those shares after the LBO. In this case, MarkerCo management hold 8% of the shares, and PrivEq wish to retain the managers after the transaction. As a result PrivEq only buys the other 92% of the shares, reducing the funds required to complete the transaction. In this case, the dollar amount of the equity rollover is 8% of the equity purchase price.

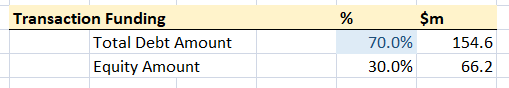

Transaction Funding

The company executing the buyout, in this case PrivEq, must decide what percentage of the purchase price will be funded by debt and what percentage will be funded by equity. In this case, the total debt amount will equal 70% of the transaction price. The dollar amounts are then calculated by multiplying the percentages by the total funds required from the funds required section.

Fees and Cash Limits

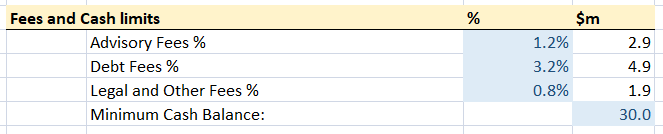

Finally we must account for fees associated with the transaction. There are three main fees associated with transactions like this:

- Advisory fees: These are typically paid to an investment bank for helping to execute the transaction. These fees vary depending on deal size and whether the bank represents the buyer or the seller. Investment banks are only paid if a deal closes. This is more likely when selling a business, so the fees when representing a seller, like MarkerCo here, are generally lower than when representing a buyer. This fee is a percentage of the Purchase Equity Price

- Debt fees: These are costs associated with issuing the loans and other debt instruments included in the deal, including fees and commissions to banks, law firms involved in debt issuance, and other such actors. These fees are generally assumed to be a percentage of the total debt issued, from the transaction funding section.

- Legal and Other Fees: Similar to the above, these are fees paid to law firms involved more generally in the transaction. These are calculated as a percentage of the Purchase Equity Price, and they are usually smaller than the investment banking fees.

In all the cases above, the dollar amounts are found by multiplying the percentage by the Purchase Equity Price. These fees are often neglected when calculating returns, but can have a significant impact. This is especially the case for smaller transactions, where the fees are generally a greater percentage of the total funds required.

The final figure in this section is the minimum cash balance. When a company is acquired in an LBO, interest payments on debt can quickly deplete the company’s cash balance. Imposing a minimum cash balance aims to prevent this becoming a major problem, by setting a cash balance that should not be breached. In the case of MarkerCo, we impose a minimum cash balance of 30 million. This figure is determined based on an analysis of the company’s current cash position, and their projected future cash flows

Conclusion

Transaction assumptions are an essential part of a Leveraged Buyout model. They determine key factors that will affect the model, including the Enterprise Value, the proportions of debt and equity, and the funds required.

It may seem difficult to come up with assumptions like this at the start of the LBO modelling process, but it is important to do so, as these assumptions have effects throughout the rest of the model. These assumptions can always be tweaked later on if you need to, and a well-designed model will ensure that these changes propagate through the rest of your model straight away.